The Ecomatrix Institute of Certified ESG Practitioners (“CEP

Institute”) offers a series of educational programs for aspiring and practicing ESG practitioners.

Our comprehensive program offerings include both theory and practice-based training, which are

designed to meet the requirements of the reporting requirements of major stock exchanges. The

Institute builds upon extensive research and expertise in this field, to help you gain the necessary

knowledge and skills to succeed as an ESG practitioner.

We adhere to the following values on our mission to foster the development of

a more sustainable world.

to achieve ESG excellence & sustainable growth.

between ESG regulators, corporates and practitioners.

to bridge the gap between setting and achieving ESG goals.

for ESG agendas and facilitate a growing ESG community.

We adhere to the following values on our mission to foster the development of a

more sustainable world.

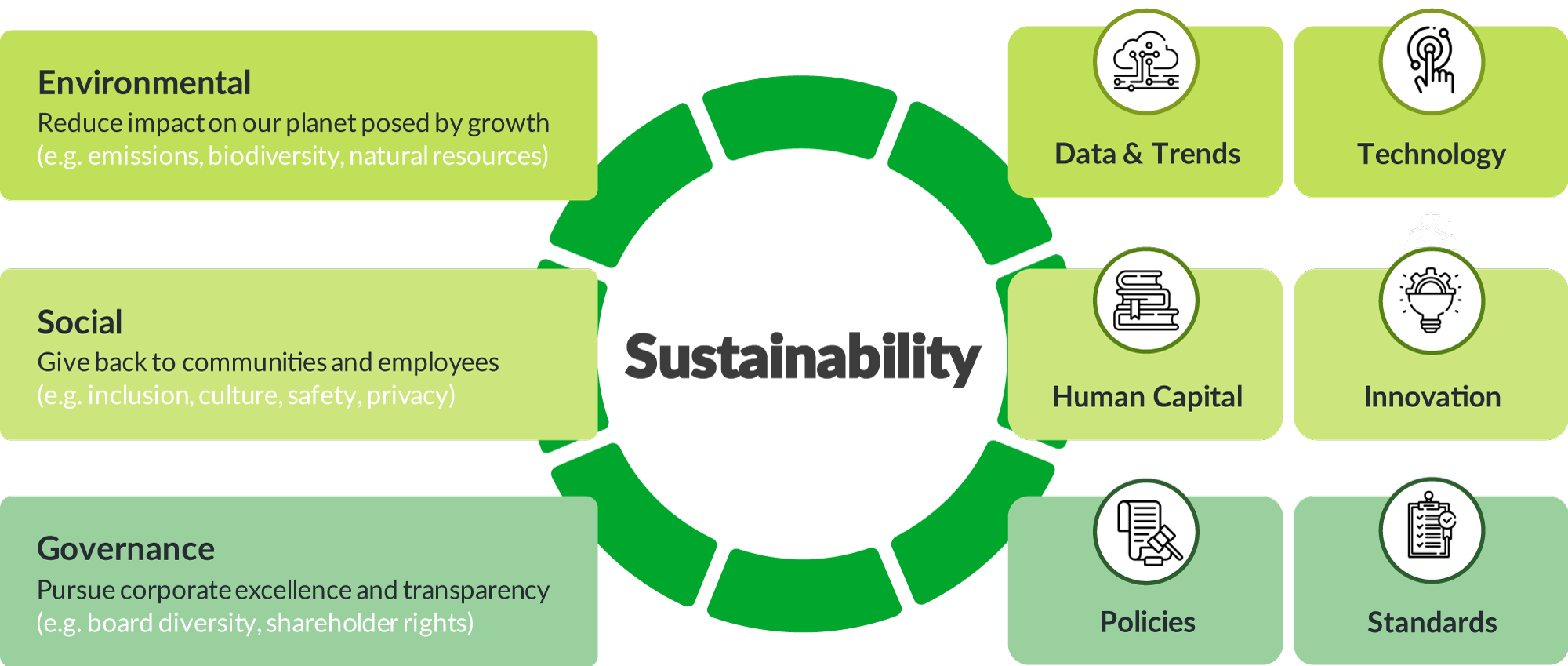

Creating long-term value requires both a focus on financial and sustainability performance. This means we need toolsfor measuring sustainability performance just as we have for financial performance.

Our Committee is composed of ESG experts and thought leaders representing

different industries. Our committee brings together each expert’s experience and connections to provide

professional and authoritative advice on each pillar of our services. Our Committee is responsible for

devising high-level strategies and overseeing our provision of services.

There is more recent discussion and growing importance for ESG (environmental, social & governance) reporting and ESG investing in the financial sector. To cope with the increasing demand, this certificated course endeavours to cover ESG elements ranging from its history to regulatory requirements which are essential to ESG administrators.

This is the first level on the path to a Professional

Certificate in ESG Administration leading to Certified ESG Administrator (CESGA), “How to

Comply with Latest ESG Reporting Requirements for Better Reporting”, which includes ESG

implications, Green Finance in Hong Kong, concerns and advice from Hong Kong Exchanges and

Clearing Limited (HKEX), and highlights of the latest ESG reporting rules.

Level 1 introduces ESG’s background, its implications and provides an overall

view of the ESG landscape, to equip learners with fundamental knowledge on ESG. Green

Finance in Hong Kong illustrates different surveys, statistics and offers analysis regarding

Hong Kong’s development on Green Finance as a financial market regulator. In the Concerns

and Advice from HKEX part, you would learn about key insights of HKEX on ESG, while the

following chapter on Highlights of the latest ESG Reporting Rules includes the latest

developments, to supplement basic principles and boundaries in ESG reporting that

administrators should be aware of and comply with.

If you are interested in the

basics of ESG reporting, upon completion of this section, you would be able to gain a good

understanding of the fundamentals in ESG reporting.

This is the second section of the four-stage accreditation

course. The first level of the course offers a general overview of ESG reporting; the levels

after go into detail of each E, S, and G pillar. Level 2 delves into the reporting

requirements pertaining to a company’s environmental practices.

Environmental

conservation has emerged as a prominent issue of concern for businesses, governments and

citizens alike. Thus for corporates, it is an integral part of corporate social

responsibility (“CSR”), as a material factor related to the sustainability of our world, the

well-being of societies, and profitability. Therefore, accurate, effective and timely

reporting of companies’ endeavors in environmental conservation has never been more

important.

Upon completion of this level, you will be equipped with the skill to report companies’ performance in environmental conservation professionally, and have an understanding of setting up environmental KPIs to track performance in a structured manner over time.

This is the third part of the four-part accreditation course.

After the environmental session is covered, the social element of ESG would be introduced.

As the third part of the course, the guide titled “What are the Social KPIs that

you should manage properly to comply with the New ESG Rules?” would dive deep into

different practices in employment & labor, operation as well as the community aspects.

Not only would framework of “social” aspect for ESG in HKEX listing rules being introduced,

but relevant policies inside listed companies would also be discussed.

The guide

serves to inform:

Upon completion of level 3, you will master the reporting requirements and conventions pertinent to social aspects of ESG. You will be able to plan, lead, organize and evaluate effective social practices pursuant to Hong Kong Exchanges and Clearing Limited (HKEX) Listing Rules.

This is the last part of the four-part accreditation course.

This section provides a specialist perspective on the governance aspect of ESG reporting.

Good corporate governance is the key to corporate growth; it provides a

structure through which companies achieve their objectives and monitor their performance. It

also enables companies to incentivize the board, management and employees to pursue the said

objectives, by means of maintaining good relationships. In light of its importance, there

arises a need to properly report companies’ performance in corporate governance.

In accordance with the Hong Kong Exchanges and Clearing Limited (HKEX) Listing

Rules, the guide serves to inform the following:

Upon completion of this section, you will master the reporting requirements and conventions pertinent to corporate governance, in addition to learning how to plan, lead, organize and evaluate effective corporate governance practices pursuant to Hong Kong Exchanges and Clearing Limited (HKEX) Listing Rules.